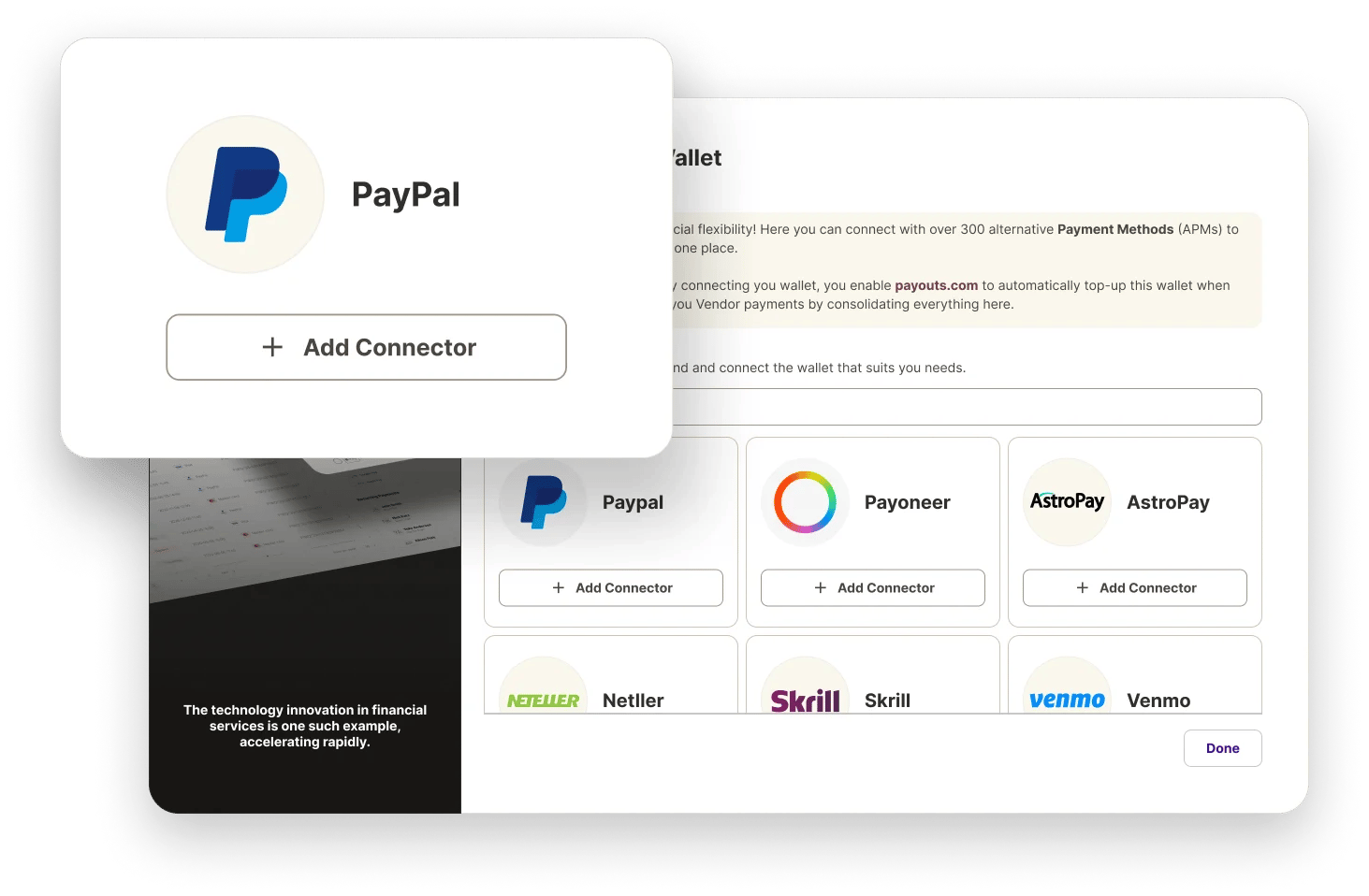

SUPPORTED EWALLETS

Send Payouts to eWallets

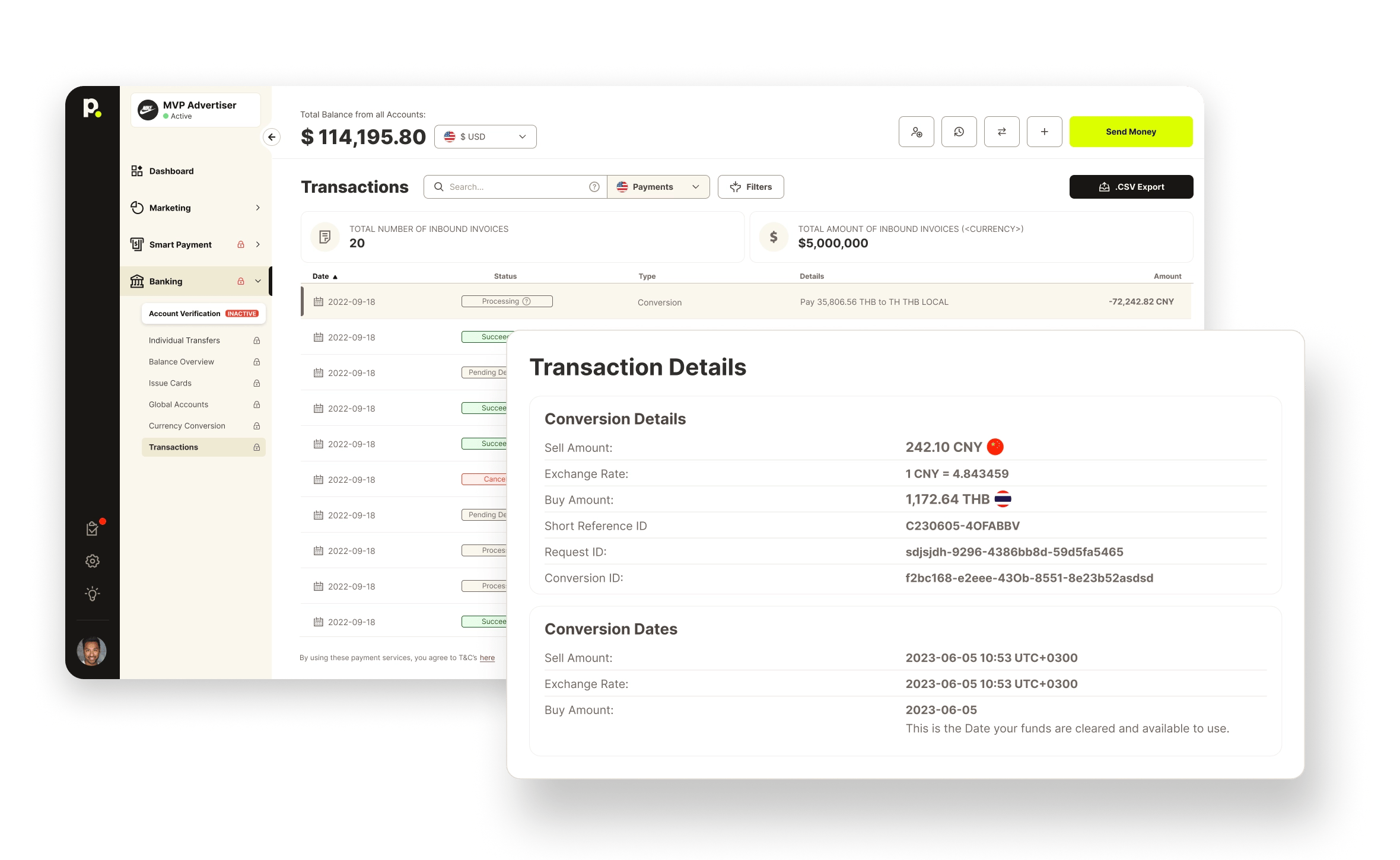

Payouts.com integrates the top global eWallet platforms, enabling businesses to instantly disburse payments, earnings and commissions to recipients worldwide. This provides a compliant, lower-cost payout delivery system leveraging leading international eWallets to transfer funds swiftly in local currencies. The result: smooth cross-border commerce.

- Instant Global Disbursements

- Robust Reporting & Reconciliation

- Transaction Tracking and Notifications

Global Payouts Powered by Leading eWallets

Payouts.com has integrated connections with the most widely used international eWallet platforms including PayPal, Payoneer, Skrill, Neteller and Venmo. This provides the ability to disburse funds instantly in local currencies to freelancers, remote contractors, affiliates and merchant partners globally who rely on digital wallets.

PayPal

Instantly send payouts in over 25 currencies to millions of PayPal account holders across more than 200 markets.

Send Payouts Payoneer

Transfer funds to over 3 million freelancers and remote contractors who rely on Payoneer globally.

Send Payouts Skrill

Formerly Moneybookers, Skrill serves over 36 million wallet account holders worldwide in 200+ countries.

Send Payouts Venmo

Owned by PayPal, Venmo sees over 60 billion in payment volume annually and continues rapid user growth.

Send Payouts Neteller

A long-standing pioneer in the online wallet and money transfer space with over 23 million member accounts.

Send Payouts Zelle

US bank-backed platform enabling over 1.7 billion free instant P2P transfers yearly between US accounts.

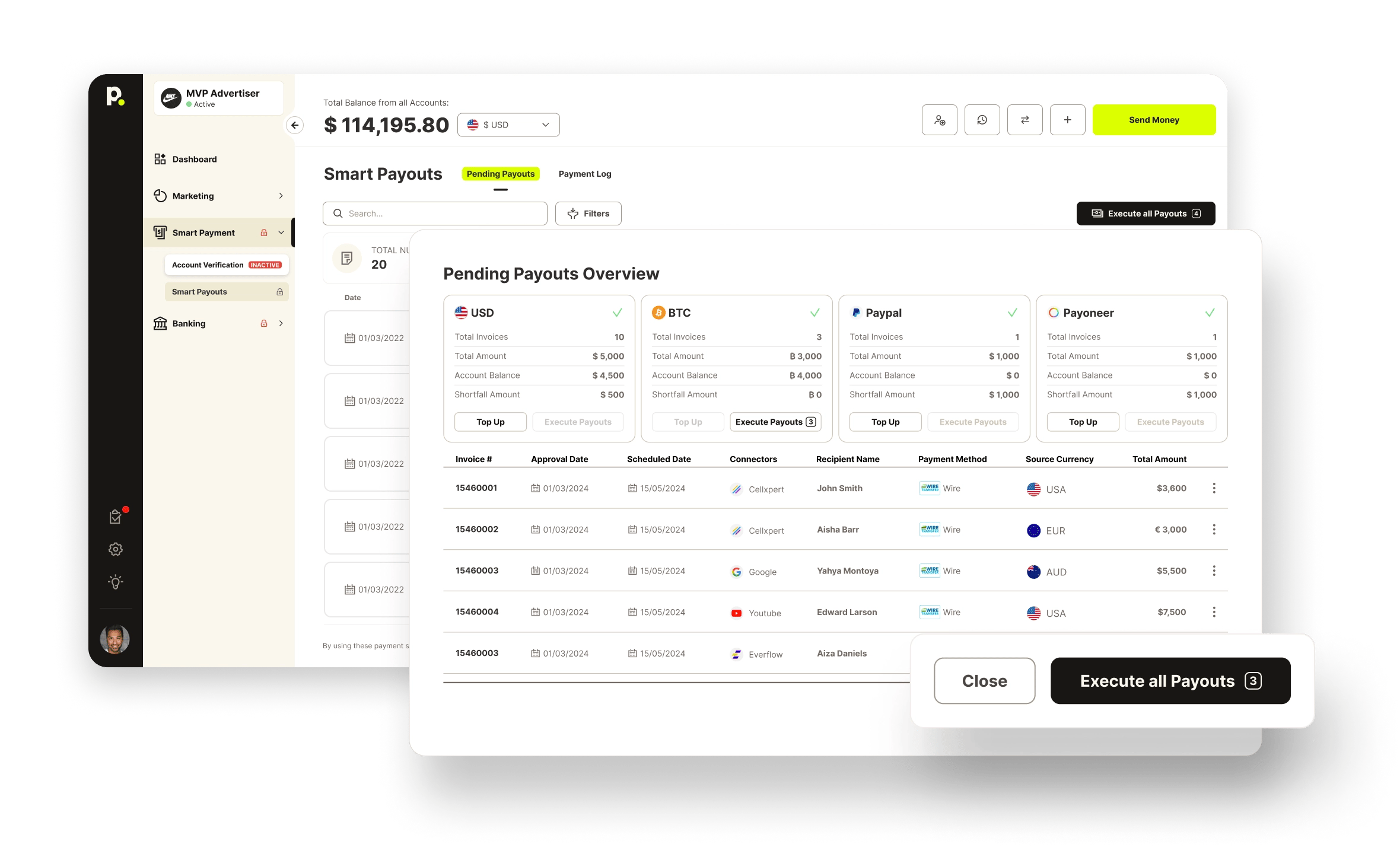

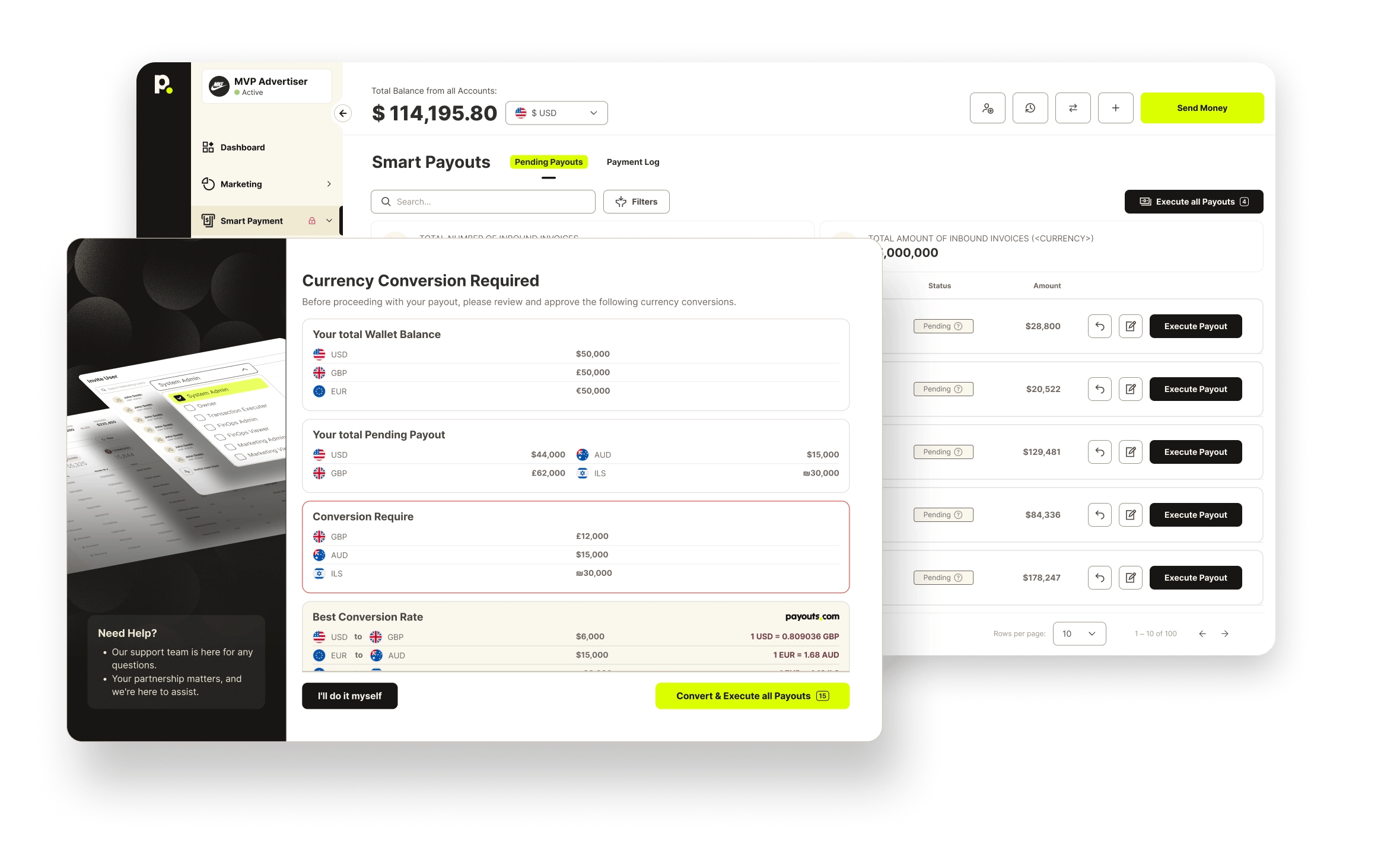

Send Payouts Faster Global Fund Access

Send earnings instantly with integrated eWallet transfers.

Instant Payouts

Funds are dispatched from the business instantly upon payment initiation to recipient eWallet accounts, enabling near real-time delivery.

Near real-time fund settlement

Recipients gain access to money sent in near real-time, avoiding long bank settlement wait times for access to their earnings.

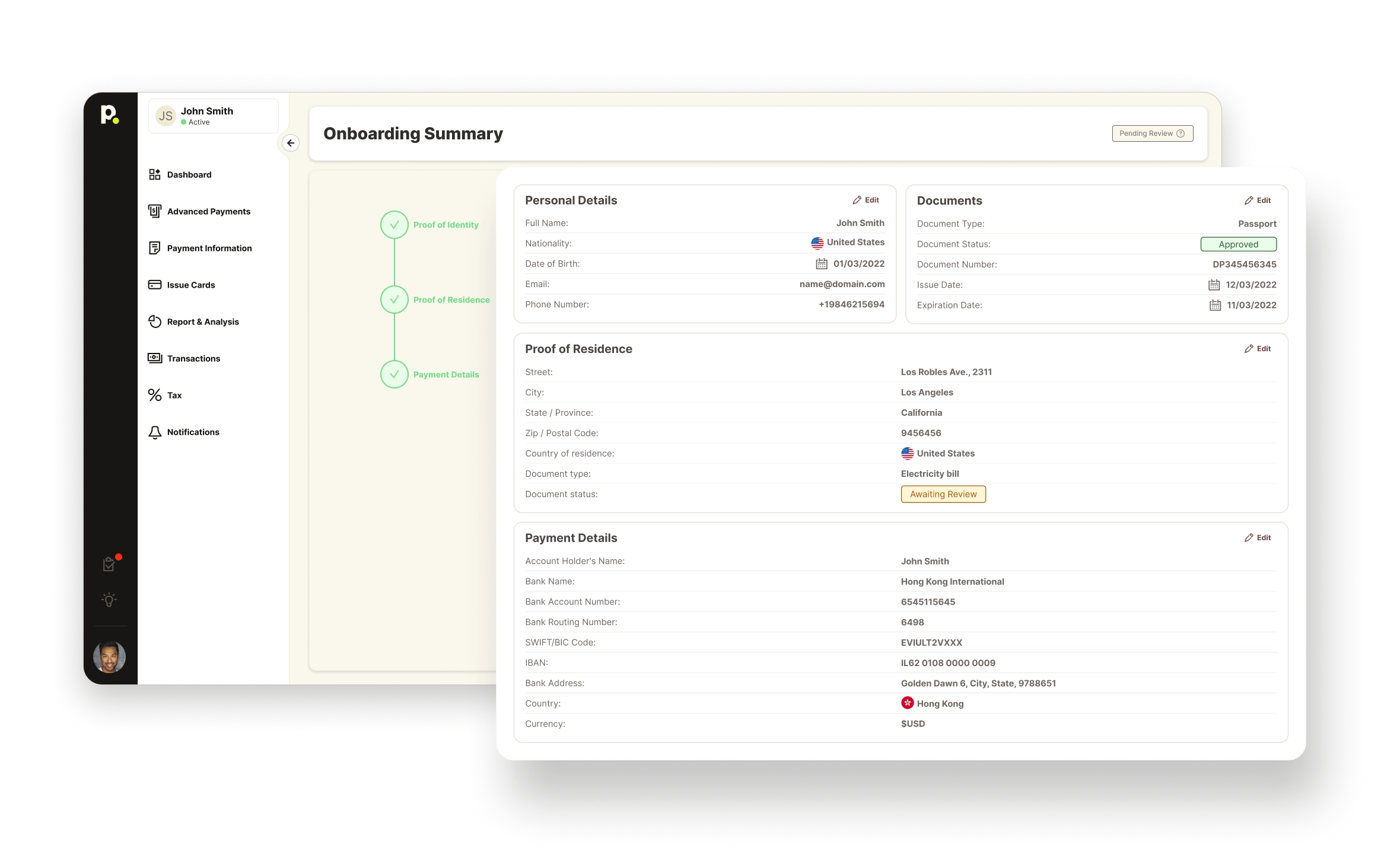

Simplified Compliance

Robust controls provide compliant payout capabilities.

Automated recipient identity verification checks

Advanced identity checks are automated for every recipient against key global regulatory watchlists during onboarding.

Ongoing transaction monitoring

Sophisticated algorithms flag suspicious transactions for review, while robust analysis identifies possible money laundering or terrorist financing.

Still have questions?

Can’t find the answer you’re looking for? Please chat to our friendly team.